tax identity theft meaning

Damian Williams the United States Attorney for the Southern District of New York announced that ARIEL JIMENEZ aka Melo was sentenced to 12 years in prison in. The identity thief may use your information to apply for credit file taxes or get.

The most common method is to use a persons authentic name address and Social Security Number to.

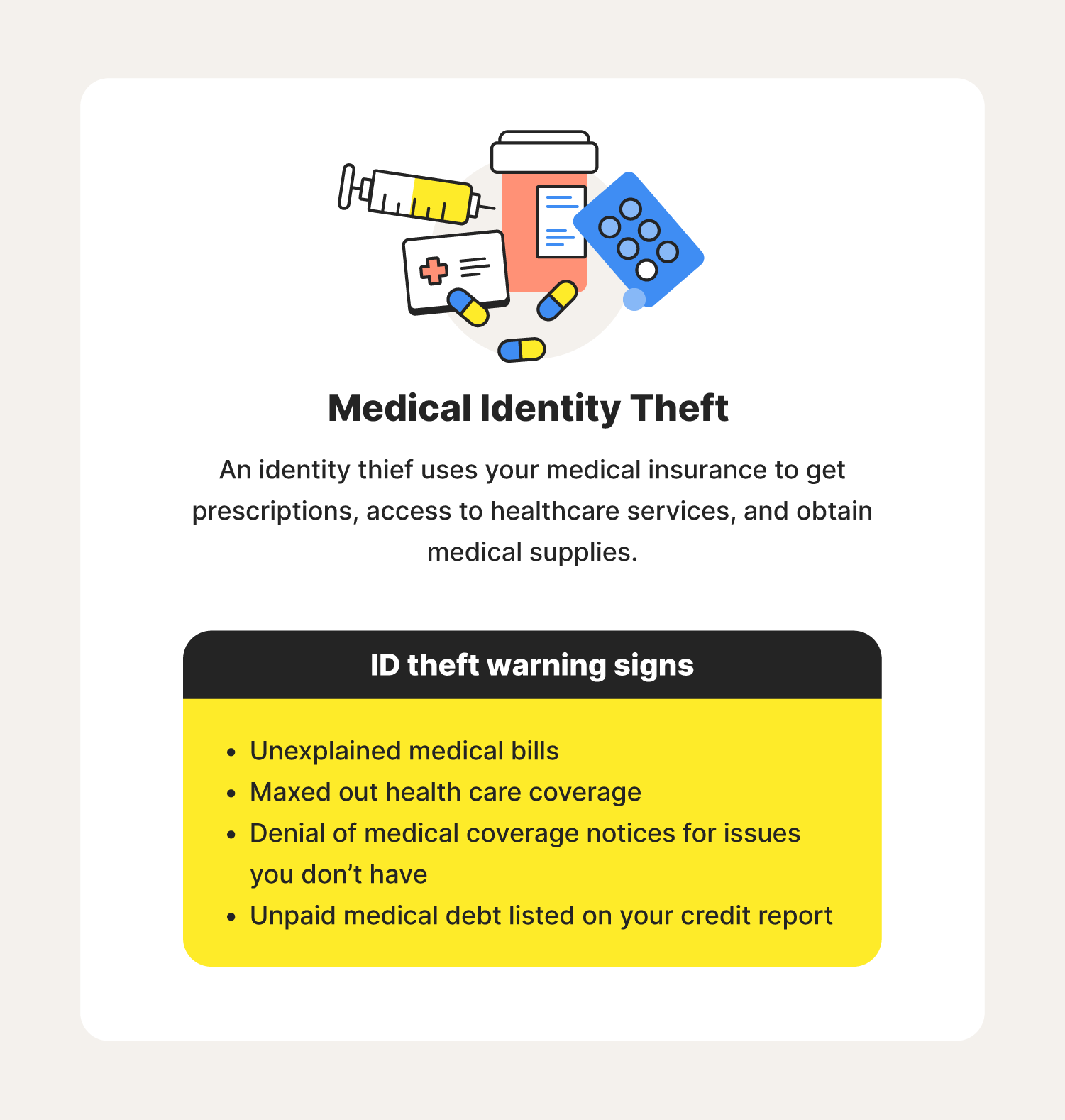

. More from HR Block. Tax identity thieves steal taxpayers names and Taxpayer Identification Numbers like Social Security Numbers or Individual Taxpayer Identification Numbers for one. Identity theft is the crime of obtaining the personal or financial information of another person for the sole purpose of assuming that persons name or identity to make transactions.

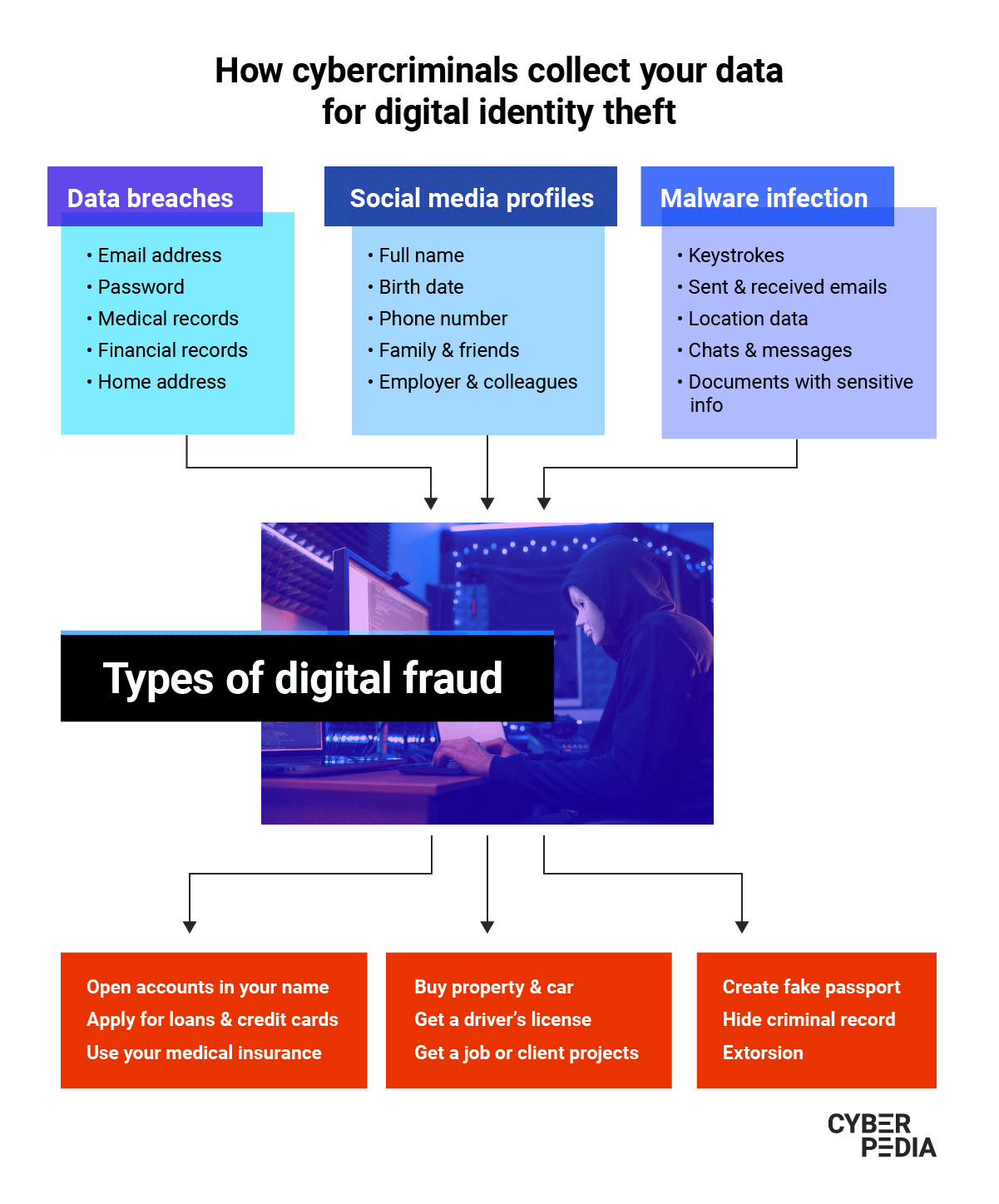

Identity ID theft happens when someone steals your personal information to commit fraud. There are a lot of ways ones identity can be stolen. Equipped with three simple ingredients a name birthdate and Social Security.

Tax identity theft occurs when someone steals your Social Security Number SSN and uses it to file a fraudulent return in your name in order to steal your refund assuming that. This is done so that the thief can. One of the major identity theft categories is tax identity theft.

This offense in most circumstances carries a maximum term of 15 years imprisonment a fine and criminal forfeiture of any personal property used or intended to be. Tax return identity theft is the act of filing a return using a stolen identity and taking the victims refund. Tax-related identity theft occurs when someone uses your stolen personal information including your Social Security number.

Tax identity theft is when a criminal steals your information specifically your Social Security number and uses it to file a fraudulent tax return. Tax identity theft is when someone uses your Social Security number to steal your tax refund or for work. People often discover tax identity theft when they file their tax returns.

515 Casualty Disaster and Theft Losses. The IRS outlines its definition of tax identity theft as occurring when someone uses your stolen personal information. Using all 3 will keep your identity and data safer.

Generally you may deduct casualty and theft losses relating to your home household items and vehicles on your federal income tax. We explain concepts simply without bells and whistles or formality to help you live your best financial life. MoneyTips exists to provide personal finance advice that you can trust.

Best Identity Theft Protection Services In 2022 Safehome Org

![]()

Business Identity Theft National Cybersecurity Society

Tax Identity Theft Awareness Consumer Advice

Business Identity Theft National Cybersecurity Society

/tax-indentification-number-tin.asp_final-7524207031a4442187c30846d85f1ee2.png)

Tax Identification Number Tin Definition Types And How To Get One

Guide To Irs Form 14039 Identity Theft Affidavit Turbotax Tax Tips Videos

Identity Theft What Is Is And How To Prevent It

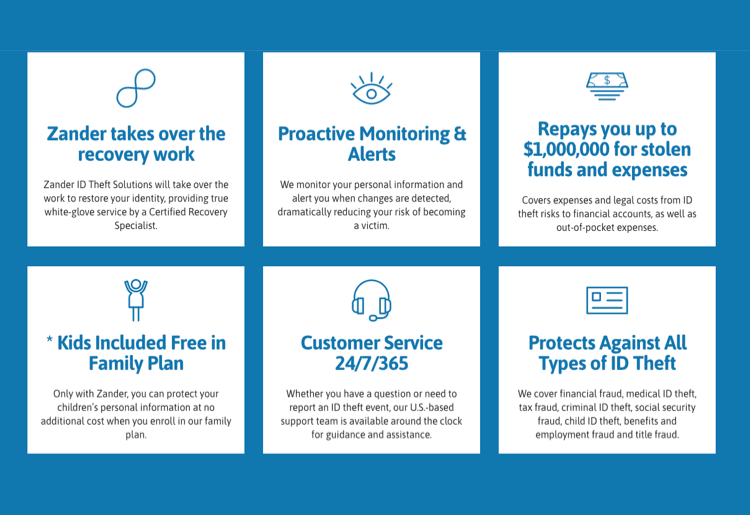

Top 10 Best Identity Theft Protection Services Companies 2022

7 Tips To Prevent Tax Identity Fraud Central Bank

Identity Theft Resource Center Guidestar Profile

Everything You Need To Know About Tax Identity Theft C D Llp

7 Best Identity Theft Protection Services Of October 2022 Money

The How And Why Of Tax Identity Theft Itrc

Most People Shouldn T Pay For Identity Theft Protection Reviews By Wirecutter

How To Prevent Identity Theft Id Theft Statistics For 2022 Norton

Identity Theft And Fraudulent Tax Returns Steps To Prevent

Identity Theft Definition Stats Protection Techpout

Child Identity Theft How It Happens What To Do About It Aura